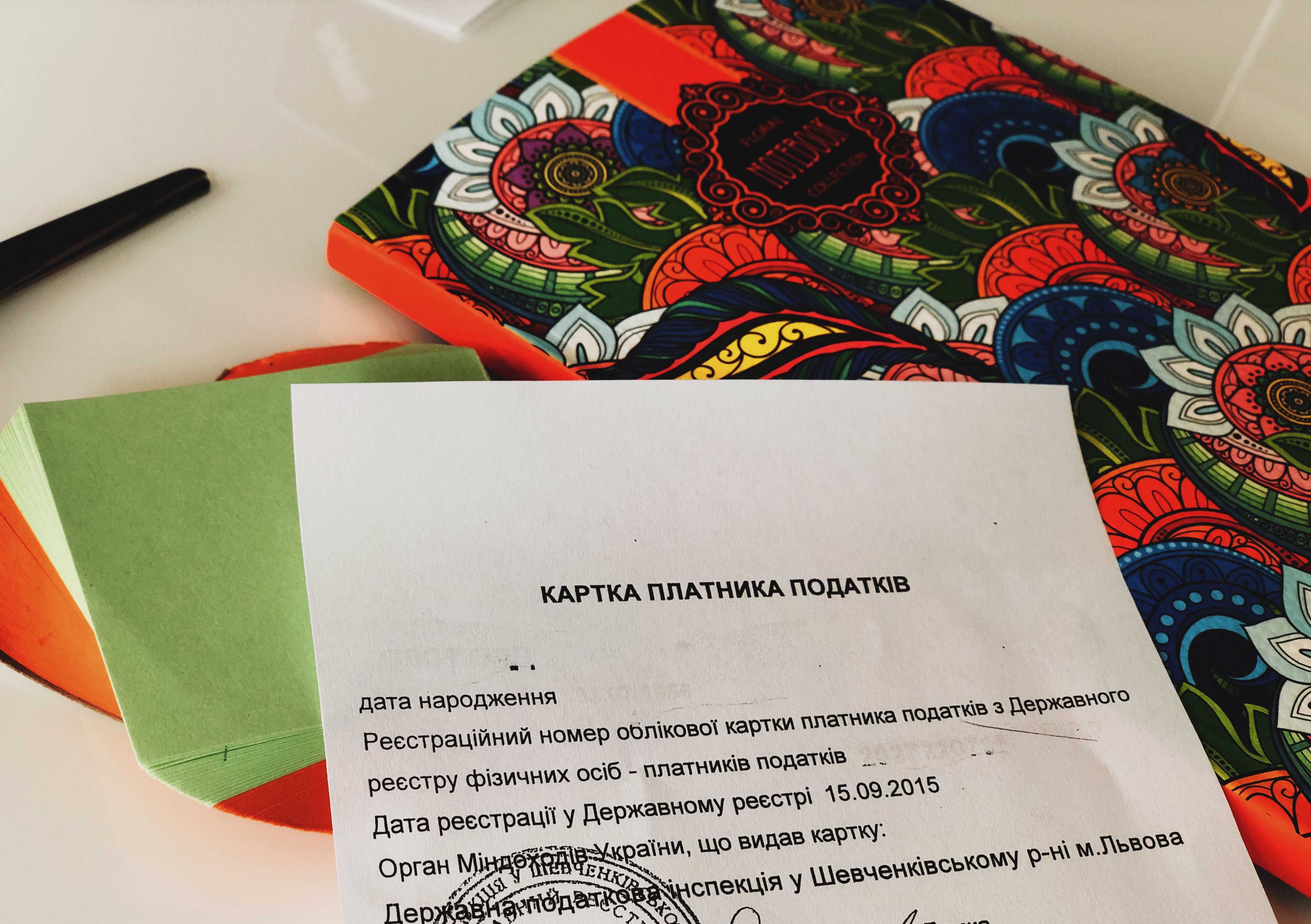

The taxes are the main things of forming part of the state budget, which are levied on legal persons and individual persons according to the current national legislation. So, every individual person is a taxpayer. There is appropriate document of taxpayer with personal number according to taxpayer account. There are many titles of this ID (the registration number of the taxpayer’s account is a new title, you can also find: tax identification number, identification code). The most commonly used title of this ID is the identification number.

Tax identification number is an individual number of every person and it consists of 10 numbers. This tax number is necessary for every person in Ukraine, especially for committing certain actions (procedures) in future, which are listed below.

Why is this tax identification number (ID number) needed?

Every person collided with situations, where is required to indicate personal tax number. There are different situations, such as filling in certain official documents, regestration notarial power of attorney in the notary of your district, or settle down various contracts, or register an official employment, or pay in the cash desk of the service local bank. Especially this number is important for profit in the Ukraine. Any income received by an individual person should be taxed according to the domestic legislation of Ukraine.

All individual persons – are the taxpayers, thats why they are registered in the State Register of Taxpayers.

Who can get an ID number?

- Citizen of Ukraine;

- Foreigner;

- Person without citizenship.

Required documents for registration of tax identification number (ID number)

- Citizens of Ukraine should submit:

- Application Form established by the Regulation of registration of individual persons in the State Register of Individual persons (Exhibit 2);

* The application form must be completed in advance, other information about application form is listed below.

- Passport of a citizen of Ukraine and copies of pages of this passport.

* You can present a passport with a note on the registration of documents for the departure of Ukrainian citizens abroad for permanent residence.

- Foreigners and persons without citizenship should submit:

- Application Form established by the Regulation of registration of individual persons in the State Register of Individual persons (Exhibit 2);

* Application form must be filled in Ukrainian despite the fact that this application form is submitted by a foreigner.

- Passport of a foreigner translated into Ukrainian and the copy of this translation ;

* In the other case, you can submit: 1)permanent residence permit; 2)temporary residence permit; 3) refugee identity card; 4) identity card of the person who needs additional protection.

Application form consists of information listed below:

surname, name, patronymic (if any);

date of birth;

place of birth (country, region, district, settlement);

place of residence / location;

citizenship;

for foreigners – a tax number in the country of citizenship;

details of passport (series and / or number of passport, date of issue and authority).

* If you have notarized power of attorney, application form (Tax card – taxpayer) can be submtted by a representative.

There is no minimal age to obtain the ID number. National legislation provides that every individual person (citizen of Ukraine and foreigner/person without citizenship) is obliged to get the ID number. Persons can submit Application form personally or through a representative to the relevant supervisory body.

ID number is free of charge both for the citizen of Ukraine and for the foreigner or person without citizenship (without costs for translations of passports for foreigners.

The period (term of obtaining):

- for a citizen of Ukraine – 3 days;

- for a foreigner/person without citizenship – from 3 to 5 days.

Interesting fact: ID number consists of 10 digits, each digit has its own specific meaning and the algorithm of action for their deduction.

This procedure does not take much time and efforts and you don`t need to waste your time getting the documents, because the list of the documents reduced to a minimum. However, should you have any questions, please contact us.]]>