In our previous publication http://legalaid.ua/ua/article/varianty-pobudovy-struktury-it-kompanij-v-ukrajini-chastyna-1 we have analyzed the initial scheme of IT companies, which usually is a basis for all the following.

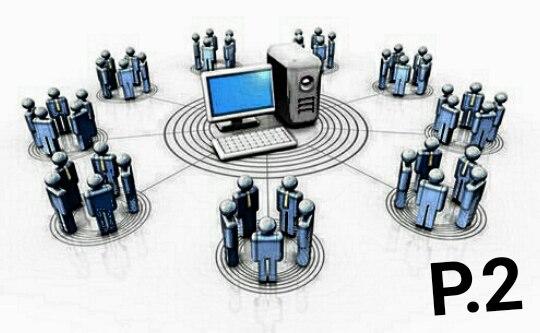

Next scheme which naturally follows from the previous one, involves a simple intermediary – an individual entrepreneur that is entrusted with organizational functions and control functions.

This option usually applies if a foreign customer (often outsourcing company) recruits development team in Ukraine for one or more projects.

A foreign customer in this case is not interested in creating a separate entity in Ukraine (subsidiary or representative office) because all contractors working within its project, transmit all IP rights, and the project is owned by a foreign company or its final client.

This gives the foreign companies some flexibility, because after the closure of the project no issues arise regarding the termination or restructuring companies or representative offices in Ukraine.

The client chooses one person who actually manages its business in Ukraine. Such a person shall be registered as private entrepreneur, performs the function of project manager, receives all or part of payments, distributes them to the costs for project development and for the services payment to other individual entrepreneurs.

Often such person is a lessee of the office and can sublease workplaces for other project executors.

This scheme has certain nuances and drawbacks.

The first group of limitations in this structure include quantitative restrictions relating to the payment amounts and composition of the team.

The income of an individual entrepreneur who is on the third group of the single tax can not exceed UAH 5000 000 a year. Thus, with large incomes and a large team PE can not receive and distribute all payment for services to all developers.

The given scheme is rarely used for a large number of performers, as with the growth of team the risk of leaving the legal framework for such activities increases.

Another nuance is the issue of office premises and fixed assets.

If one person performs the function of the office lessee and also takes on a significant part of payments for teams from abroad, it can cause a question from controlling authorities, because such scheme has signs of a foreign business without registration, tax evasion and concealment of labor relations.

Regarding the fixed assets and computer equipment, there may be questions about their owner. In fact, the customer can not directly buy them for his business in Ukraine, because de jure he does not have business here. Problems may arise in case of damage or theft of property (including by team members) or during searches or audits.

Finally, it is worth noting that often the main problem of the functioning of this structure is the lack of its understanding by the participants themselves.

Thus, developers are not always aware that they are working under contracts on providing services, are independent contractors and do not work for the Ukrainian company as such does not exist.

Foreign customers, in their turn, do not always understand that certain payments or cost compensation schemes in contracts with Ukrainian side are not possible to prescribe, because it just cause the output of the structure beyond the legitimate operation.

Therefore, considered scheme is recommended for small short or medium-term projects of foreign clients in Ukraine and is not appropriate for large Ukrainian startups or own projects, even when foreign investors are involved.

These and other schemes see in the next our publications.

Nataliia Vasylechko, Senior Associate of IT Law department, Attorneys at Law “BK Partners”

To choose the most optimal scheme for your business, taking into account all the risks and benefits, please contact us]]>